Aquaculture 2021

Theme: Aquaculture for Food and Sustainable Development

4th International Conference on Aquaculture & Marine Biology is delighted to welcome the participants from everywhere the planet to attend the distinguished conference scheduled during October 27-28, 2021 in Rome, Italy. The conference provides the global coliseum to international scholars to voice their analysis findings to the world. With representatives from all the key countries attending, the atmosphere is exciting with open and friendly interaction between attendees. This is a conference, providing a chance for the aquaculture & marine biology industry to find out regarding current and forthcoming problems, explore new developments in culture technology, and interact with others with similar interests. This conference brings along a novel and International mixture of consultants like academicians, scientists, and business professionals, general public, current and prospective fish farmers to share data and ideas regarding the development of aquaculture & marine biology. Attendees can learn about many topics relevant to aquaculture & marine biology and find out about the most recent aquaculture equipment and products by browsing the on-going Exhibition.

Session 1: Aquatic Ecosystem & Aqua Farming

Ecology is the scientific study of how organisms interact with each other and with their environment. This includes relationships between individuals of the same species, between different species, and between organisms and their physical and chemical environments. Aquatic ecology includes the study of these relationships in all aquatic environments, including oceans, estuaries, lakes, ponds, wetlands, rivers, and streams. The boundaries of an aquatic ecosystem are somewhat arbitrary, but generally enclose a system in which inflows and outflows can be estimated. Ecosystem ecologists study how nutrients, energy, and water flow through an ecosystem.

Keywords: Aquaculture Congress | Marine Biology Congress | Aquaculture Meetings | Marine Biology Meetings | Aquaculture Workshops | Marine Biology Events | Aquaculture and Marine Biology Conferences | Aquaculture Conferences

Keywords: Aquaculture Congress | Marine Biology Congress | Aquaculture Meetings | Marine Biology Meetings | Aquaculture Workshops | Marine Biology Events | Aquaculture and Marine Biology Conferences | Aquaculture Conferences

Session 2: Sustainable Aquaculture

Aquaculture is currently playing, and will continue to play, a big part in boosting global fish production and in meeting rising demand for fishery products. Aquaculture is projected to be the prime source of seafood as demand grows from the global middle class and wild capture fisheries approach their maximum take. Sustainable aquaculture is a dynamic concept and the sustainability of an aquaculture system will vary with species, location, societal norms and the state of knowledge and technology.

Keywords: Aquaculture Congress | Marine Biology Congress | Aquaculture Meetings | Marine Biology Meetings | Aquaculture Workshops | Marine Biology Events | Aquaculture and Marine Biology Conferences | Aquaculture Conferences

Session 3: Aquatic Diseases & Immunity

Aquaculture is the fastest growing sector of animal protein production and now accounts for 47-50 per cent of the world's aquatic animal food supply. Aquaculture production helps to reduce pressure on wild fisheries caused by overfishing. Diseases have emerged as a significant problem due to the high stocking densities used in intensive aquaculture. These diseases may devastate the farmed aquatic animals and spread to wild populations.

Keywords: Aquaculture Congress | Marine Biology Congress | Aquaculture Meetings | Marine Biology Meetings | Aquaculture Workshops | Marine Biology Events | Aquaculture and Marine Biology Conferences | Aquaculture Conferences

Session 4: Aquaculture Nutrition & Supplies

Aquaculture Nutrition provides a global perspective on the nutrition of all cultivated aquatic animals. Fish are consumed as food by many species, including humans. It has been an important source of protein and other nutrients for humans throughout recorded history. Health experts have long touted the nutritional benefits of fish: These sea creatures rank high on lists of the best sources of heart-healthy omega-3 fatty acids, high-quality protein, metabolism-friendly selenium, energy-boosting Vitamin B12, and inflammation-fighting Vitamin D. Omega-3s are essential nutrients that help ward off heart disease, diabetes, and metabolism-slowing inflammation, and they’re primarily found in fish.

Session 5: Aquaculture Genetics & Biotechnology

Genetic analyses have much to offer fisheries managers, especially in the provision of tools enabling unequivocal specimen identification and assessment of stock structure. Biotechnology provides powerful tools for the sustainable development of aquaculture, fisheries, as well as the food industry. Increased public demand for seafood and decreasing natural marine habitats have encouraged scientists to study ways that biotechnology can increase the production of marine food products, and making aquaculture as a growing field of animal research. Biotechnology allows scientists to identify and combine traits in fish and shellfish to increase productivity and improve quality. Scientists are investigating genes that will increase production of natural fish growth factors as well as the natural defence compounds marine organisms use to fight microbial infections.

Keywords: Aquaculture Congress | Marine Biology Congress | Aquaculture Meetings | Marine Biology Meetings | Aquaculture Workshops | Marine Biology Events | Aquaculture and Marine Biology Conferences | Aquaculture Conferences

Keywords: Aquaculture Congress | Marine Biology Congress | Aquaculture Meetings | Marine Biology Meetings | Aquaculture Workshops | Marine Biology Events | Aquaculture and Marine Biology Conferences | Aquaculture Conferences

Session 6: Marine Life & Conservation

Marine life is a vast resource, providing food, medicine, and raw materials, in addition to helping to support recreation and tourism all over the world. Marine life helps determine the very nature of our planet. Marine organisms contribute significantly to the oxygen cycle, and are involved in the regulation of the Earth's climate. Shorelines are in part shaped and protected by marine life, and some marine organisms even help create new land.

Keywords: Aquaculture Congress | Marine Biology Congress | Aquaculture Meetings | Marine Biology Meetings | Aquaculture Workshops | Marine Biology Events | Aquaculture and Marine Biology Conferences | Aquaculture Conferences

Session 7: Freshwater Biology

Freshwater biology is the scientific biological study of freshwater ecosystems and is a branch of limnology. This field seeks to understand the relationships between living organisms in their physical environment. These physical environments may include rivers, lakes, streams, or wetlands. This discipline is also widely used in industrial processes to make use of biological processes such as sewage treatment and water purification. Water flow is an essential aspect to species distribution and influence when and where species interact in freshwater environments.

Session 8: Coastal and Marine Ecosystem

Wave action hit the shoreline constantly with different strengths which shape the coastal lines resulting into various land levels. The sand dunes are made by atmospheric wind which blows in beach sand. Sedimentation in rocks, plants, animal and marine life is affected by warm weather condition. The salt is taken from the sea by wind and formation of salt crystals in the small pores in rocks leads to various rock texture. Due to the climatic change the sea levels rise and fall.

Session 9: Seafood Processing

Marine Food is any sort of ocean life thought to be food by humans. Food conspicuously includes fish and shellfish. Shellfish embody varied species of molluscs, crustaceans, and echinoderms. traditionally, ocean mammals like whales and dolphins are consumed as food, although that happens to a lesser extent in present. Edible ocean plants, like some alga and microalgae, square measure wide devoured as food round the world, particularly in Asia (see the class of ocean vegetables). In North America, though not usually within the uk, the term "marine food" is extended to water organisms devoured by humans, therefore all edible aquatic life could also be said as food.

Keywords: Aquaculture Congress | Marine Biology Congress | Aquaculture Meetings | Marine Biology Meetings | Aquaculture Workshops | Marine Biology Events | Aquaculture and Marine Biology Conferences | Aquaculture Conferences

Session 10: Fish Nutrition

Fish is consumed as a food by many species, including humans. It has been an important source of protein and other nutrients for humans throughout recorded history.The anatomy and functions of the major organs and systems in the fishes, which affect their nutrition. The sensory organs are important in fish nutrition, as the fishes use these organs to locate and investigate the acceptability of any food or feed in the environment. The oral or buccal cavity is the area where food is first consumed by the fish. The structures that aid in capture and retention of food are the taste buds, teeth, gill rakers, tongue, and esophagus.

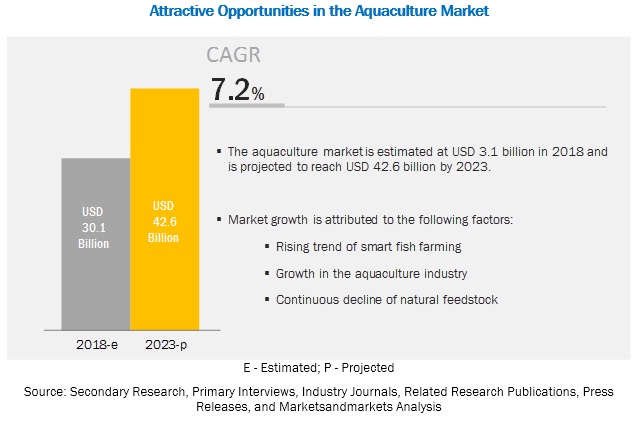

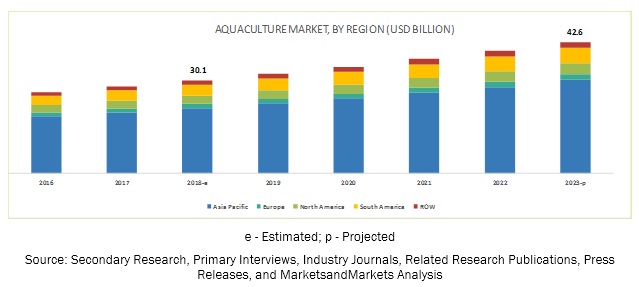

The aquaculture market is projected to grow from USD 30.1 billion in 2018 to USD 42.6 billion by 2023, recording a CAGR of 7.2% during the forecast period. This is attributed to the growing consumption of fish for its nutritional value. Furthermore, the rising trend of smart fishing and the increase in seafood trade is also propelling the demand for aquaculture products.

Asia Pacific accounted for the largest share in the market. This is attributed to a rise in demand for advanced and latest aquaculture products that help in producing more quality output with available land for aqua farming and enhance the efficiency of aquaculture operations. Further, aquaculture sectors in countries such as China, India, Vietnam, Indonesia, and Thailand are export-oriented; the aqua farming sector is of prime importance in these countries, as players here are focusing on technology adoption and automation which is expected to have a positive impact on the market in this region.

Introduction:

Aquaculture is the fastest-growing food production system in the world due to the lack of naturally available varieties of fisheries harvested in natural environments. The increasing awareness of the health benefits and nutritional value associated with seafood has accelerated its consumption. Aquatic products, especially farmed salmon and shrimps, are highly nutritious sources of food, consisting of important proteins, vitamins A, B, D, and Niacin, minerals like iodine, iron, phosphorus, and zinc. These foods also have a significant source of Omega-3 fatty acids such as docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA).

Global Aquaculture:

As per the recent reports, 35 countries produced more farmed than wild-caught fish in 2014. This group of countries has a combined population of 3.3 billion, or 45 percent of the world’s population. Countries in this group include five major producers, namely, China, India, Viet Nam, Bangladesh, and Egypt. Global aquaculture production is dominated by Asia (89 percent); China alone accounts for 62 percent.

Aquaculture in USA:

Marine aquaculture in the United States contributes to seafood supply, supports commercial fisheries, restores habitat and at-risk species, and maintains economic activity in coastal communities and at working waterfronts in every coastal state. In the United States, marine aquaculture production increased an average of 3.3 percent per year from 2009-2014, however, globally, the U.S. remains a relatively minor aquaculture producer. According to the most recent Fisheries of the United States, the U.S. ranks 16th in aquaculture production. Although a small producer, the United States is a major player in global aquaculture. The nation supplies a variety of advanced technology, feed, equipment, and investment capital to other producers around the world.

Aquaculture in Europe:

European aquaculture is stagnating by contrast with increasing rates of aquaculture production at world level. To try to dampen this trend, the Commission published two communications with strategies for developing European aquaculture, one in 2002 and another in 2009. The 2002 strategy failed to increase European production, while the global economic crisis has hit the aquaculture market and industry. This led to the publication in 2013 of a third Commission communication, aimed at achieving the sustainable development of EU aquaculture and proposing strategic guidelines. The main aquaculture producers among the EU Member States are Spain (22%) France (17%), the United Kingdom (16%), Italy (13%) and Greece (8.5%), which together accounted for around 77% of total aquaculture production in 2011. However, in terms of the value of production, the UK is the leading producer (21%), followed by France (19%), Greece (13%) and Spain (12%). Bivalve molluscs (mussels, oysters and clams) are dominant in Spain, France and Italy. The UK produces mainly salmon, while Greece produces mainly sea bass and sea bream.

Aquaculture in Asia:

The Asia-Pacific region has taken a step forward in the development of a coordinated strategy and action plan that will lead to the sustainable intensification of aquaculture. Aquaculture is a critical sector in this region which presently supplies more than 90 percent of world production. In total, aquaculture is responsible for more than half of all fisheries products we consume, and demand for aquaculture products is expected to increase. While Asia-Pacific’s aquaculture outputs help nourish the world, they are also responsible for more than 20 percent of total protein intake of people living within the region. However, as it is the most populous region of the world, and with heavy demands on natural resources, Asian aquaculture will face great challenges to sustain its growth and meet the increasing demand for fish inside and outside the region. It is estimated that fish consumption in Asia and the Pacific will increase by 30 percent by 2030 and aquaculture production may need to increase by 50 percent during that time to meet increased global demand for fish.

Aquaculture in Middle East:

Fisheries and aquaculture production in the Middle East is relatively small and remains under developed. Production from the region amounts to only 2% of the total world production. Fish production in the Middle East has gradually been increasing at a growth rate of 16%. Egypt is the biggest producer in both capture fisheries and aquaculture, supplying 40% of the total production in the Middle East. As in the rest of the world, aquaculture’s contribution to the Middle East’s total production has grown. This trend is stronger in the Middle East than in many other parts of the world. Yemen and Oman, which produce 6% and 5% of the total fisheries production in the region, are the leading exporting nations in the Middle East by volumes.

Aquaculture in France:

Aquaculture in France has an important tradition and history. France was one of the pioneers in Europe in the development of research and technology which led to the growth of the industry in general. France is the second largest producer in Europe with a total aquaculture production of 237 451 tonnes in 2007 and €545 million in value. The greatest part of French aquaculture is the production of shellfish (190 000 tonnes) and finfish (55 000 tonnes), of which marine aquaculture is the smallest part at 9.000 tonnes. Marine aquaculture in France has stagnated over the past 5 years due to the constraints on sites and the relatively higher cost of production of farms in relation to competition from Greece and Turkey. There are approximately 30 production units operating in France. The marine aquaculture industry in France is still very fragmented with 40 individual companies occupying 46 production sites, including hatcheries and or on-growing units. There is only one company with an annual production of more than 1000 tonnes and two companies with a production between 500 and 1000 tonnes. There are eight hatcheries operating in France, with an annual production of 34 420 million European seabass and 26 740 million gilthead seabream in 2007. Close to 70 percent of juveniles production is exported mainly to Greece and Spain.

The aquaculture sector is facing a lot of challenges, such as impact of climate change and variability, urbanization and related social and economic changes. Thus the only way to meet the increasing demand for fish is to promote sustainable intensification of aquaculture, while ensuring environmental sustainability, which means “to produce more with less” by increasing the productivity and efficiency in aquaculture production with reduced consumption of resources and mitigating negative environmental and social impacts.Global Agriculture & Aquaculture Universities:

- Iowa State University, USA

- Purdue University, USA

- Royal Agricultural University, England

- Harper Adams University, UK

- University of Reading, UK

- University of Aberdeen, Scotland

- University of St Andrews, UK

- Mendel University, Czech Republic

- Swedish University of Agricultural Sciences, Sweden

- University of Dubrovnik, Croatia

- Beijing Agricultural University, China

- Southwest University, China

- Nanjing Agricultural University, China

Global Agriculture & Aquaculture Research Centers & Associations:

- Andalusian Center for Marine Science and Technology, Rome

- Consultative Group for International Agricultural Research, Italy

- Bioversity International, Italy

- Estonian Marine Institute, Estonia

- The Marine Institute, Ireland

- Marine and Food Technological Centre, Spain

- International Crops Research Institute for the Semi-Arid Tropics (ICRISAT), India

- Bureau of Fisheries and Aquatic Resources, Philippines

- National Aquaculture Group Red Sea Aquaculture, Saudi Arabia

Global Agriculture & Aquaculture Companies:

- Golden State Foods, USA

- Kerry Group, Ireland

- Vilmorin, France

- Adler Seeds, USA

- China Agri-Industries Holdings, China

- ContiGroup Companies, Belgium

- Case Corporation, USA

- Heritage Foods, India

- New Holland Agriculture, Italy

- John Deere Tractor, USA

Funding Agencies:

- National Oceanic and Atmospheric Administration

- PROFISH

- European Maritime and Fisheries Fund

- Food and Agriculture Organization

Conclusion:

The rapid expansions in fish, poultry, and livestock farming due to the high demand and attractive profit margins will imminently result in an oversupply of products. As farm gate prices eventually fall, production costs and competitiveness of aquaculture could be improved through the greater use of fertilizers. However, the prospect of a significantly increasing yield in the country’s 200,000 ha of predominantly shallow brackish water milkfish ponds through improved fertilization practices will be difficult to realize unless the ponds are deepened or life support systems are used. Competing use with agriculture is already limiting the supply of chicken manure in major aquaculture centres although the abundant supply of livestock manure offers a potentially valuable resource if technology and economic feasibility for its use can be established.

- Aquaculture and Fisheries

- Aquatic Ecosystem & Aqua Farming

- Aquatic Diseases & Immunity

- Coastal and Marine Ecosystem

- Fish Nutrition

- Freshwater Biology

- Fisheries Science & Research

- Sustainable Aquaculture

- Seafood Processing

- Marine Biology

- Marine Biology and Aquatic Science

- Journal of Aquaculture and Fisheries Management

- Journal of Marine Biology and Oceanography

- Insights in Aquaculture and Biotechnology

2 Organizing Committee Members

4 Renowned Speakers

man gil, Ahn

Hainet Korea Corporation

South Korea

Napoleon Tsanis

Aquaculture Europrawn Hellas A. E.

Greece

Salah Kamal

Central Laboratory for Aquaculture Research

Egypt

THIAGO MARINHO PEREIRA

FEDERAL UNIVERSITY OF WESTERN,

Brazil